World—Foreign investment jumps as Australia invests more in Asia

After a steady downward trajectory in global foreign direct investment (FDI) flows since 2015, exacerbated by the pandemic, FDI flows surged 88% in 2021 to over US$1.8 trillion (about 2% of global GDP). Global FDI flows are now 37% above pre-pandemic levels, according to the OECD. The surge largely reflected strong earnings of foreign-owned businesses, as firms decided to re-invest instead of repatriating to parent companies. Globally, the US retained its position as the top destination for FDI (US$382 billion) and the largest source of FDI (US$434 billion). But the data also highlights weakness in greenfield investment projects in emerging markets and developing economies, which sits 43% below pre-pandemic levels, portending slower economic growth ahead. Moreover, global FDI flows in 2022 face mounting pressure from heightened geopolitical risks.

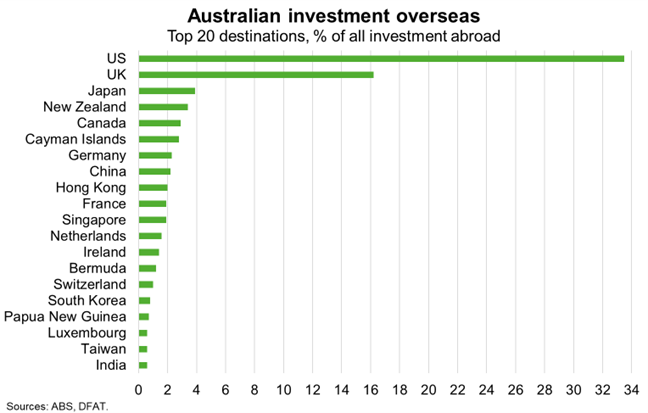

The US and the UK remained the two largest economies for Australian outbound investment in 2021, totalling over $1.6 billion and accounting for about 50% of Australia’s investment abroad (including FDI and portfolio investments). But while investment ties are large, trade linkages are smaller; the US and UK accounted for only 13% of Australia’s goods and services trade in 2020. Australian investment in Asia has increased sharply over the past decade; investment in China, Hong Kong, India, Japan, South Korea, Taiwan and the ASEAN economies totalled $430 million in 2021, up from $129 million in 2011. But this group, which accounted for 62.7% of Australia’s total goods and services trade in 2020, accounts for only 13% of Australia’s foreign investment (Chart). Asia’s robust economic fundamentals, including favourable demographics, rising urbanisation, industrial development and abundant natural resources, offers significant opportunities for Australia to boost its investment in the region. That would support growth in Australian exports—including food and beverages, education, tourism and healthcare.