Japan—Weaker yen and higher inflation hit consumers and businesses

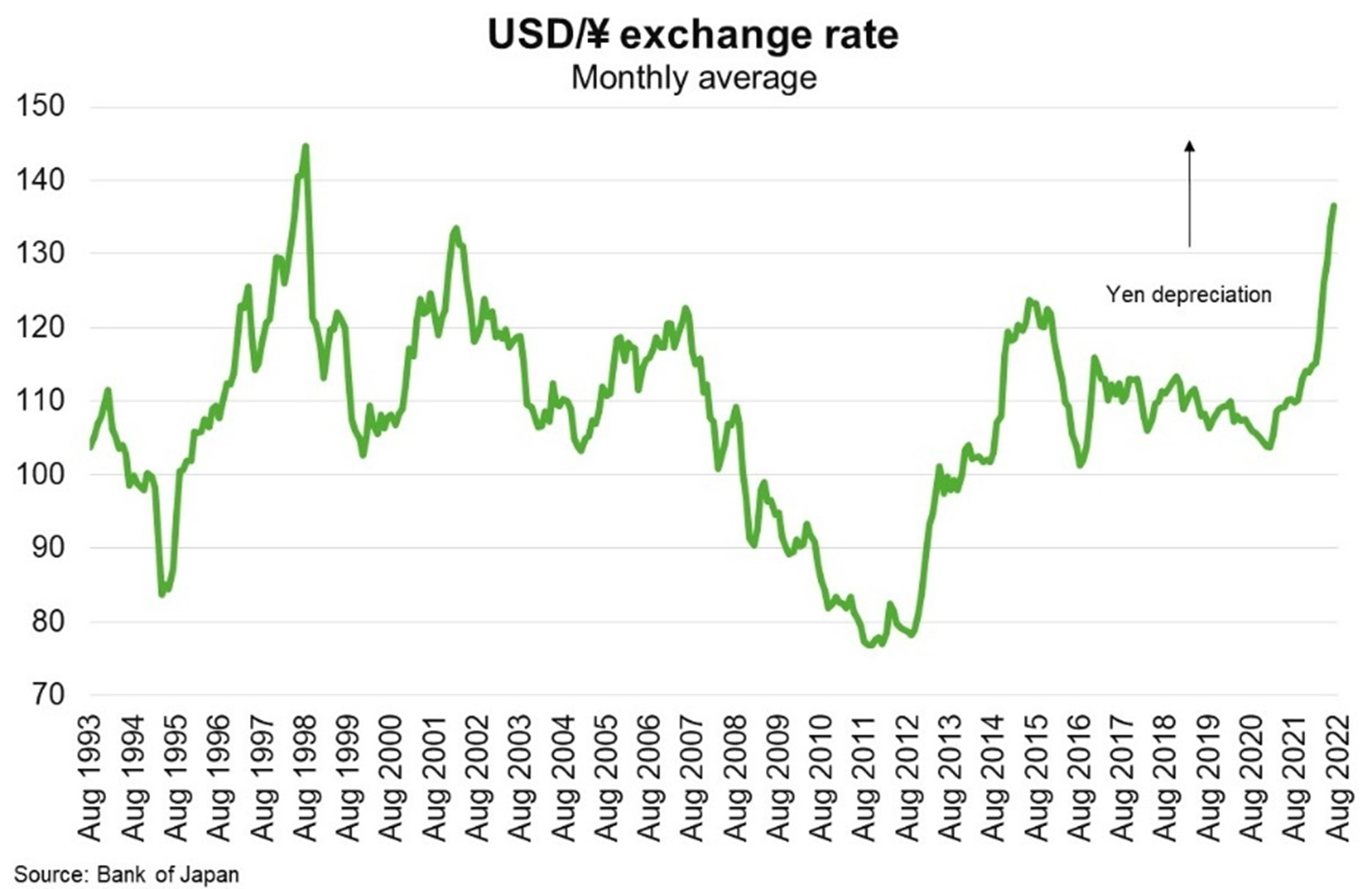

Japan’s economy has long-faced flat or falling prices that prompt the country’s typically conservative consumers to save rather than spend, making it difficult to spur economic growth on a sustainable basis. Inflation is now increasing; the headline consumer price index remained above 2% year-over-year for the third straight month in June. Meanwhile, the yen recently hit ¥138/USD, its lowest level against the US dollar in more than two decades (Chart).

But these forces may be more negative than positive for the world’s third last economy and Australia’s second largest export market. That’s because the rise in consumer prices is being driven by rising food and energy costs rather than sustained increases in wages and economic activity. This is contributing to cost-of-living pressures, undermining consumer sentiment and eroding households’ purchasing power. The weakening of the yen, while positive for export competitiveness, exacerbates inflation pressure by raising the cost of imported goods for consumers and businesses. Furthermore, the export boost from the lower yen is likely to be weak, because global demand is slowing and many Japanese companies produce their goods in lower-cost countries (such as Thailand and Vietnam), reducing the importance of the yen’s value.

Australia exported $46 billion to Japan in 2020-21, or 10% of total goods and services exports. Traditional exports to Japan, including natural gas, coal, iron ore, beef and copper, may be resilient to Japan’s economic headwinds. But more prolonged yen depreciation and higher inflation that prompts consumers and businesses to cut spending would dim the outlook for Japan’s economy and Australian exports.