© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Asia—Trade dependence increases vulnerability to protectionism

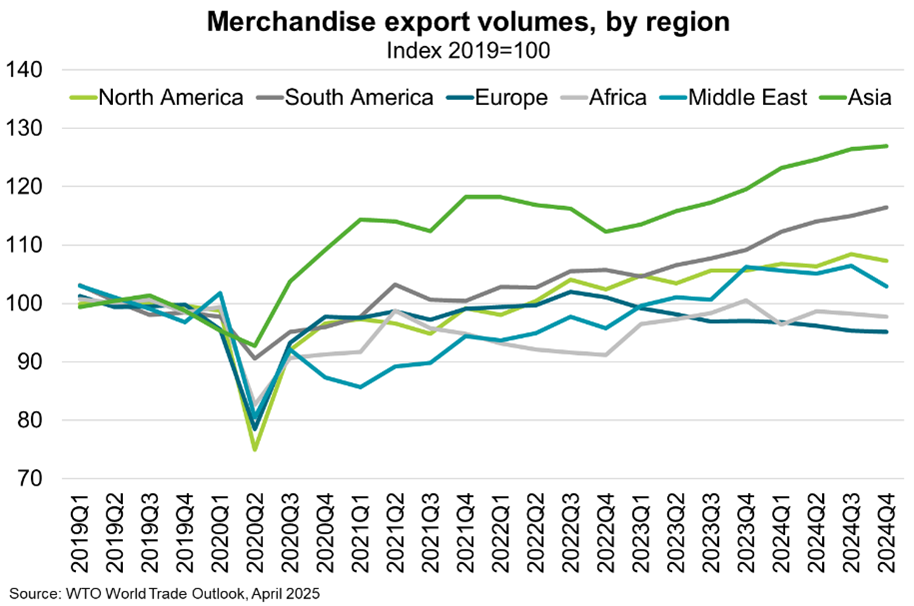

Strong exports and investment saw Asia account for nearly 60% of global growth in 2024, despite lacklustre domestic demand. Robust exports (Chart) reflected demand for high-technology products, including a surge driven by artificial intelligence. However, Asia is particularly exposed to trade tensions and fragmentation.

Some of the steepest US reciprocal tariffs announced on 2 April were aimed at Asia, the destination for 82% of Australia’s goods exports in FY2024. A 90-day pause has provided respite, with governments across the region negotiating to secure trade deals with the US before the pause expires on 9 July. China and the US have separately negotiated to lower prohibitive tariffs on each other’s exports. However, trade policy uncertainty will remain high, especially while tensions between the US and China linger. Against this backdrop, the IMF forecasts regional growth to slow to 3.9% this year from 4.6% last year.

In China, despite direct-to-the-pocket demand-side stimulus and monetary easing, the IMF’s GDP growth forecasts were downgraded to 4% this year and next, from 5% last year. Similarly, GDP growth for ASEAN countries was downgraded to 4.1% in 2025 and 3.9% in 2026, from 4.8% in 2024. Trade redirection and production relocation following the rise in US–China trade tensions in 2018 have seen these economies increase their exposure to US demand, heightening their vulnerability to protectionism. In India, which is less open relative to other economies, the growth outlook is more stable at 6.2% in 2025 and 6.3% in 2026, supported by private consumption. While a structural slowdown in Asia would weigh on Australia’s export outlook, the dominance of resources for which Australia is a relatively low-cost producer, limits the effect largely to prices rather than volumes. Lower intermediate input prices that have weighed on business confidence could also result as China redirects trade to open economies such as Australia.