Guinea—Military’s assumption of power may impact on commodity markets

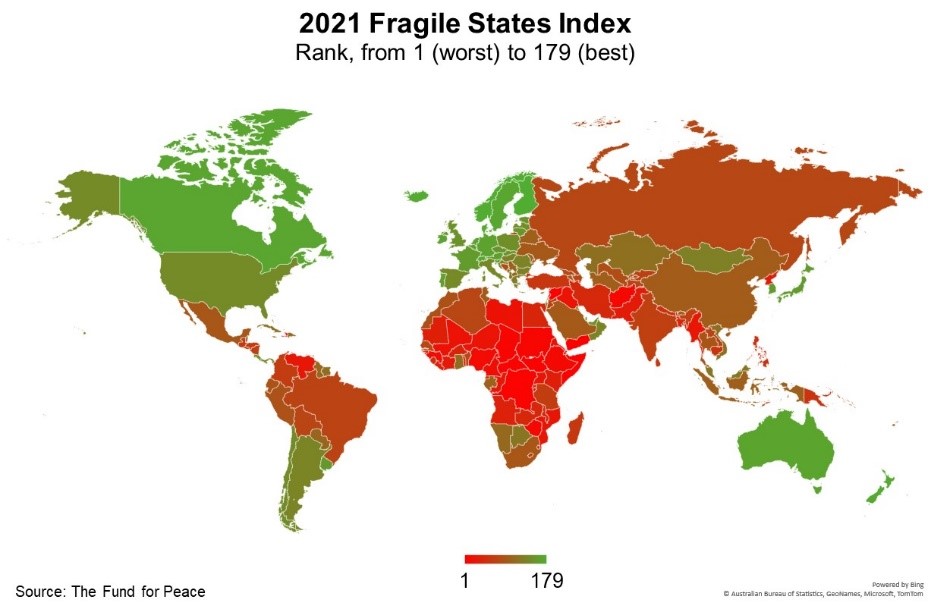

Lieutenant Colonel Mamady Doumbouya dissolved Guinea’s constitution and government this month, citing poverty and endemic corruption for deposing President Alpha Condé. This is the latest example of democratic backsliding in West Africa; in just over a year, two episodes of military intervention in Mali and a disputed succession in Chad have occurred. The world’s most fragile states are concentrated in this region (Chart).

But Guinea plays an outsized role in global commodity markets. The country’s exports of bauxite, an ore processed into aluminium, have risen dramatically over recent years. Guinea now provides half of China’s imported bauxite, while China produces half the world’s aluminium. Even before the recent events, aluminium prices were on a tear. World demand is expected to remain strong but whether the coup will limit supply is unclear. The junta has said existing business enterprises will be safeguarded. Mining companies have been permitted to work through curfews and vessel tracking data confirm no significant disruptions. However, the longer-term ramifications for Guinea’s mining sector are uncertain.

To the extent that higher geopolitical and security risks disrupt the supply of resources from Guinea, China may face tightening supply for certain commodities, impacting its longer-term diversification efforts. Australia is a major producer of aluminium, alumina and bauxite, with export earnings forecast to reach $13 billion in 2022–23. According to the Department of Industry, Science, Energy and Resources, increasing competition from Guinea’s bauxite exporters was a key risk to Australian exporters prior to the coup. Further, while bauxite is the current hero of Guinea’s mining sector, the Simandou mountains are thought to hold the world's largest untapped reserve of high-quality iron ore. China’s interest in Simandou aims to diversify iron ore imports, currently concentrated in Australia and (to a lesser extent) Brazil. Uncertainty generated by the military may worsen prospects for successful development of the deposit.