© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

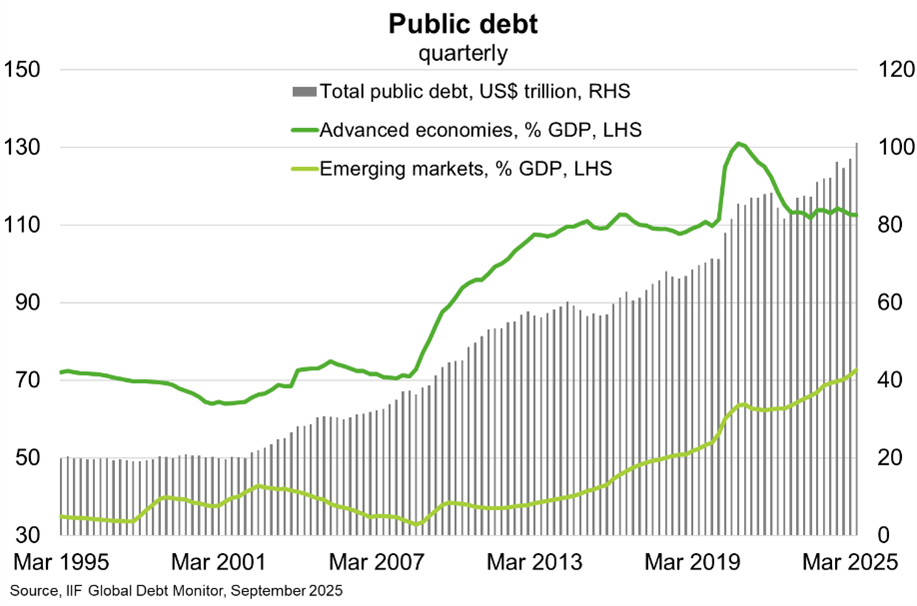

World—Public finance vulnerabilities add to financial stability risks

Public finances are increasingly strained by elevated debt levels, new spending needs, lower growth prospects and higher real interest rates. Indeed, global public debt hit a record US$101 trillion in Q2 2025. Emerging markets have seen the fastest accumulation, with public debt up almost 20 percentage points since the onset of COVID-19 to 73% of GDP. Meanwhile, public debt remains above 110% of GDP in advanced economies, only slightly down (thanks to inflation) from the recent record high (Chart).

New spending needs—for aging populations, defence, economic security, natural disasters and climate change—mean average fiscal deficits remain high (at 4.6% and 6.1% of GDP for advanced economies and emerging markets respectively this year, according to the IMF). Persistent lackluster economic performance is exacerbating the burden of rising public debt, with the IMF forecasting medium term growth prospects dimming for about two-thirds of the world economy (measured by purchasing power parity), and a more pronounced decline for emerging markets. Rising interest expenses is another pressure on public finances, with any abrupt market reactions to fiscal vulnerabilities potentially driving up borrowing costs further, increasing debt-service costs and reducing other critical spending. In the context of elevated policy uncertainty, these pressures leave countries vulnerable should a large external shock occur, with low-income countries particularly exposed given reduced aid flows.

Fiscal vulnerabilities may interact with other financial market fragilities that cause higher borrowing costs and debt rollover risks for governments. For instance, the IMF warns that maturity mismatches and leverage among nonbank financial institutions could ripple through to other assets, inducing higher government bond yields. At the same time, this could trigger disorderly price corrections that weigh on firm and household balance sheets, compounding economic damage via investment and consumption.