© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Emerging Asia—Resilient to global shocks but risk of social unrest rising

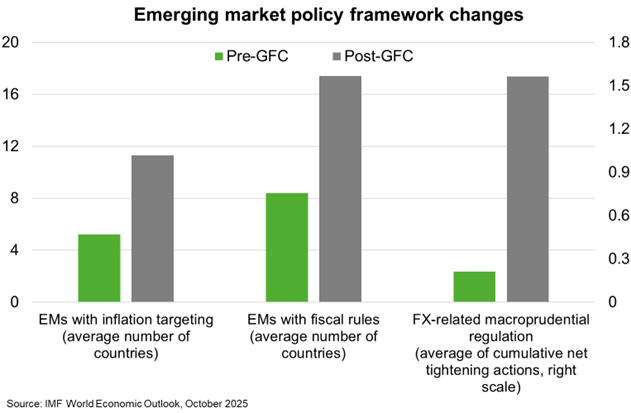

Emerging markets have historically been vulnerable to global financial shocks, often experiencing economic instability during periods of heightened risk aversion. However, emerging Asia has shown remarkable resilience in recent years. Favourable external conditions—steady growth in advanced economies, high export prices and easier financial conditions—contributed to this resilience. In addition, improved monetary, macroprudential, and fiscal frameworks also bolstered the capacity to withstand shocks. For instance, the number of emerging markets with inflation targeting and fiscal rules doubled following the GFC (Chart). Greater resilience bodes well for continued steady growth, despite increasing regularity of shocks.

Asia remains the fastest growing region in the world, projected to contribute 60% of global growth in 2025. Nevertheless, higher US tariffs will eventually reduce demand for Asian exports, dragging on employment and investment. Private consumption may provide a backstop, given low inflation and falling interest rates across much of the region and efforts by governments to stimulate the domestic economy. But overall, GDP growth in emerging Asia is expected to fall from 5.3% in 2024, to 5.2% in 2025 and 4.7% in 2026.

Slower growth may exacerbate popular resentment towards inequality and corruption that have increased social tensions this year—highlighted by protests in Nepal, the Philippines, Indonesia, Bangladesh, Timor-Leste and Mongolia. While this could prompt efforts to strengthen governance, in some cases, it could drag further on economic performance through protest related disruptions and populist policy responses. For instance, Philippine protests have seen a corruption investigation which is dampening investor sentiment. Meanwhile, social unrest in Indonesia in August-September has elevated investor concerns about the government’s fiscal anchors and the IMF warns that protracted political uncertainty in Thailand could further undermine confidence and growth.