© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Sri Lanka—Economic recovery in train as new President takes office

Anura Kumara Dissanayake, leader of the Janatha Vimukthi Peramuna (JVP) party, won the Presidential election on September 21. Shortly after, he dissolved parliament and scheduled a parliamentary election for November 14. Ahead of the polls, discussions with the IMF on its US$3 billion bailout program will be a key focus for the government. During campaigning, Dissanayake said he would not abandon the program, but look to prioritise policies that benefited the poor, including potentially easing tax burdens and reversing other government revenue raising measures.

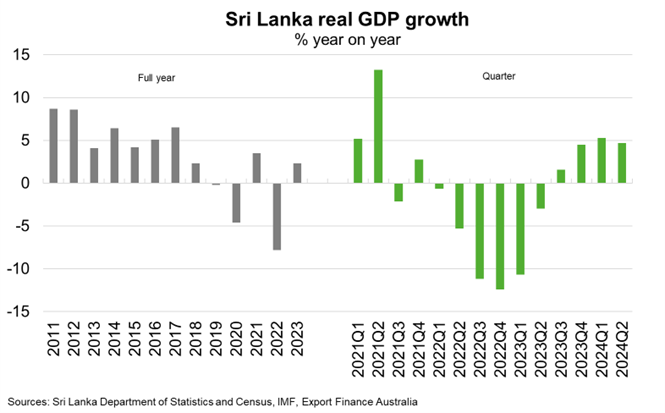

The IMF welcomed the new administration’s commitment to reforms to build on recent economic gains. Since the IMF program commenced in March 2023, increases in tax rates, an increasingly flexible exchange rate regime, enhanced governance of state-owned enterprises and progress on debt restructuring, have helped foster recovery in the economy and public finances. Real GDP has expanded for four consecutive quarters since Q3 2023, registering growth of 4.7% year-over-year in Q2 2024 (Chart). Foreign exchange reserves reached US$6 billion at end-September, up from US$1.8 billion when the government defaulted in April 2022. Inflation is below the central bank’s 5% target and domestic borrowing rates have declined. Economic revival has helped arrest a declining trend in Australian exports since 2019; exports jumped 60% year-over-year in 2023 to $1.4 billion, surpassing 2019’s high of $1.1 billion, thanks to recovery in Sri Lankan demand for Australian education and tourism.

But the outlook is not without significant risks that could undo these gains. Reopening IMF talks or backsliding on recently negotiated debt restructuring agreements with holders of international sovereign bonds, the Paris Club and China, would delay much-needed external financing. Civil unrest could also flare if the government is unable to deliver on its promise to ease public economic hardship.