© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Advanced economies—Declining inflation supports consumer spending

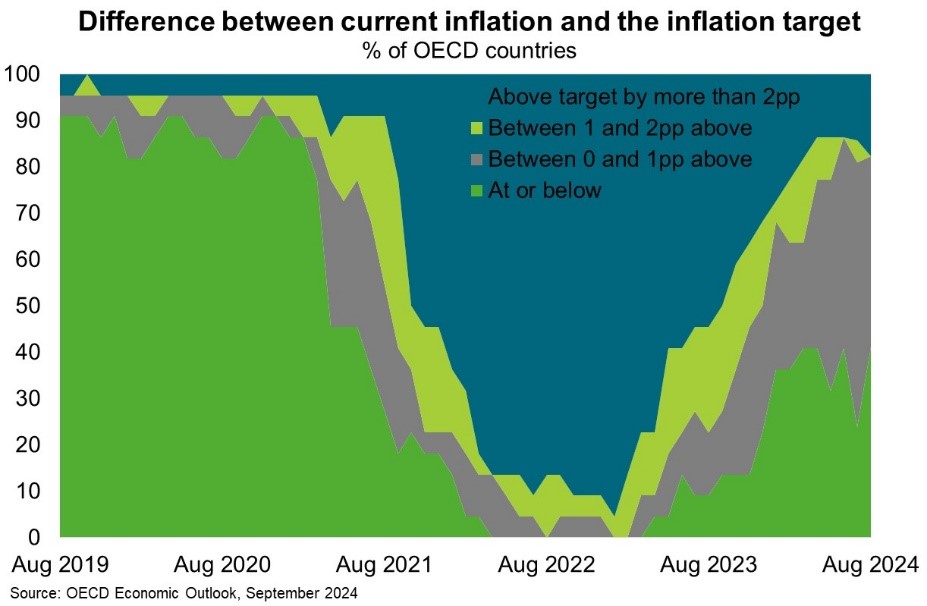

The OECD forecasts global growth to stabilise at 3.2% in both 2024 and 2025, in line with the average pace observed through the first half of this year. Despite sticky services price rises, inflation has continued to decline in most OECD countries, reflecting lower food price inflation and low, or declining, energy and goods price inflation. Inflation is now at, or approaching, central bank targets in four-fifths of OECD economies (Chart).

Meanwhile, the number of job vacancies has fallen steadily from peak levels during the pandemic and survey measures confirm moderating labour shortages in major advanced economies. As inflation and labour market pressures ease, most advanced economy central banks have commenced monetary easing. For instance, the US Federal Reserve cut the federal funds rate by 50 bps to 4.75-5.00% in September and the European Central Bank cut interest rates for a second consecutive month to 3.25% in October—the first back-to-back cut in 13 years. Declining inflation boosts real income growth and provides a tailwind to household spending. Lower interest rates will also support interest-rate-sensitive expenditures in 2025.

However, growth in advanced economies is diverging. US economic growth is projected to slow over coming quarters from the solid pace observed in H1 2024, with real GDP growth forecast at 2.6% in 2024 and 1.6% in 2025. Meanwhile, euro area GDP growth is forecast to strengthen from 0.7% in 2024 to 1.3% in 2025. Similarly, Japan’s GDP growth is forecast to strengthen from 0.1% in 2024 to 1.4% in 2025.

Significant risks remain. Sticky inflation could result from continued labour cost growth, high shipping costs and additional geopolitical or trade tensions. Growth could slow more sharply as labour markets cool. Weaker economic growth or higher inflation could trigger financial market turbulence, particularly given high debt levels.