Vietnam — Economic growth accelerating despite slow policymaking

The government’s ongoing anti-corruption campaign—that resulted in a third top official stepping down from the Communist Party of Vietnam (CPV) in just over eight weeks in May—is contributing to slow policymaking, as officials fear being entangled in investigations. Domestic political turbulence adds to regulatory hurdles and burdensome approval procedures for much-needed projects, making it difficult for Vietnam to address gaps in areas such as infrastructure and electricity transmission. Indeed, at least US$2.5 billion in foreign aid has reportedly been returned over the last three years and another US$1 billion could be similarly forfeited because of administrative paralysis (in total, nearly 1% of GDP). Further, the government reportedly spent one-quarter less than its planned budget from 2021 to 2023, the equivalent of about US$19 billion (4.3% of GDP).

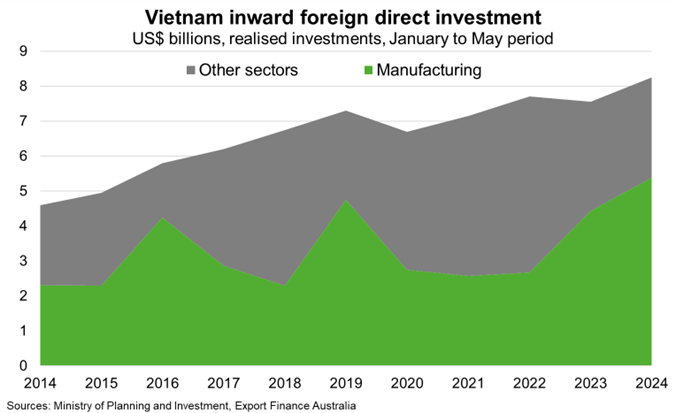

That said, despite challenges to policymaking and ongoing pressures in real estate, Vietnam’s real GDP continues to grow strongly, up 5.7% year-over-year in Q1 2024. Growing inflows of foreign direct investment highlights the rise of Vietnam as an alternative manufacturing hub to China, a trend that should continue unless US foreign trade policies materially shift (Chart). The recent tightening of US and European Union trade restrictions on China could prompt even more foreign investment into Vietnam, given the country’s advantages of low labour costs, an educated workforce and a large and growing population. Vietnam’s business environment has also improved alongside global economic integration and trade liberalisation through participation in multiple international trade deals. These factors support the government’s higher GDP growth target of 6%-6.5% for 2024, up from 5% in 2023. Continued robust growth in Australia’s 10th largest export market presents significant opportunities for a range of exporters, including resources, energy, wheat and meat. Services—including education and professional services—are also well positioned to capitalise on Vietnam’s continued robust growth.