Australia—Concerns over demand conditions overtake supply issues

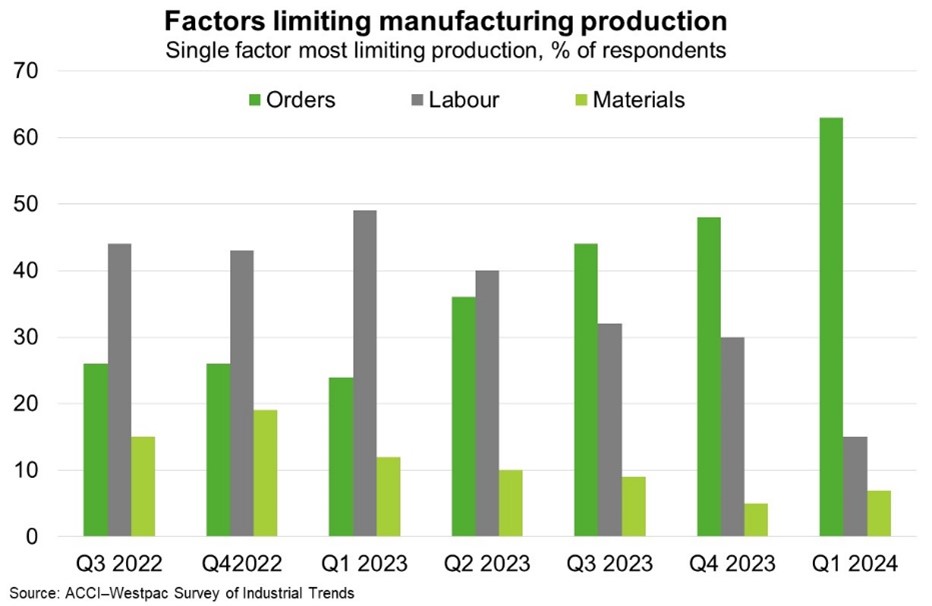

Australian business confidence remains below average, according to the NAB Monthly Business Survey, and external administrations have surged to a record high, according to the March 2024 CreditorWatch Business Risk Index. As higher interest rates gradually slow the domestic economy, demand concerns are overtaking supply-side issues. Indeed, ‘orders’ were cited by 63% of manufacturers as the single factor most limiting production in the Q1 2024 ACCI-Westpac Survey of Industrial Trends (Chart), compared to 24% a year earlier and the 2009-19 average of 59.5%. Meanwhile, the share of firms identifying ‘labour’ as the factor most limiting production has halved from 30% in Q4 2023 to 15% in Q1 2024, as the supply of labour expands. Similarly, ‘material’ shortages are a declining concern, but at 7% in Q1 2024, remain well above the 2% average observed between the GFC and COVID 19 pandemic. Cost pressures, while still elevated, are trending down from their recent historic peak.

Indeed, the US Federal Reserve’s Global Supply Chain Pressure Index remained near its historical average in March. This is despite attacks on commercial vessels in the Red Sea disrupting key trading routes connecting Europe and Asia and climate extremes reducing passages in the Panama Canal. Strong supply of container ships coming into the market after the pandemic, alongside weaker demand for goods, have helped to keep shipping cost pressures in check despite extended voyage durations. However, risks of renewed supply-side disruptions have risen. Further escalation of hostilities in the Middle East following Iran’s attacks on Israel, or a re-escalation of the war in Ukraine, could constrain cross-border flows of food, fuel, and fertiliser and lead to higher transport costs. This would hamper global trade, rekindle inflation and weigh on economic growth through tighter monetary and financial conditions.