Japan—Large wage hikes support household spending

At Japan’s annual “shunto” Spring wage talks, large companies agreed to pay the biggest wage hikes in more than 25 years amid high inflation and rising inflation expectations. For instance, Hitachi said it would increase wages by an average of 3.9%, compared to last year's 2.6% increase. Suntory Holdings indicated a 7% rise in wages, on average, and Uniqlo owner Fast Retailing plans to raise salaries up to 40% for full-time employees. Also, for the first time, major automakers fully agreed to union demands for higher wage increases and bonuses; Honda, for example, will raise wages by 5%, the largest increase since 1990. These outcomes are significant for Japanese workers, who as a group, have seen wages barely grow since the late 1990s because of subdued economic growth, an entrenched deflation mindset and a reluctance from businesses to pass on higher costs to budget-minded consumers. Wages grew about 6% between 1990-2021, far below an average 35% gain among OECD member countries during the same period.

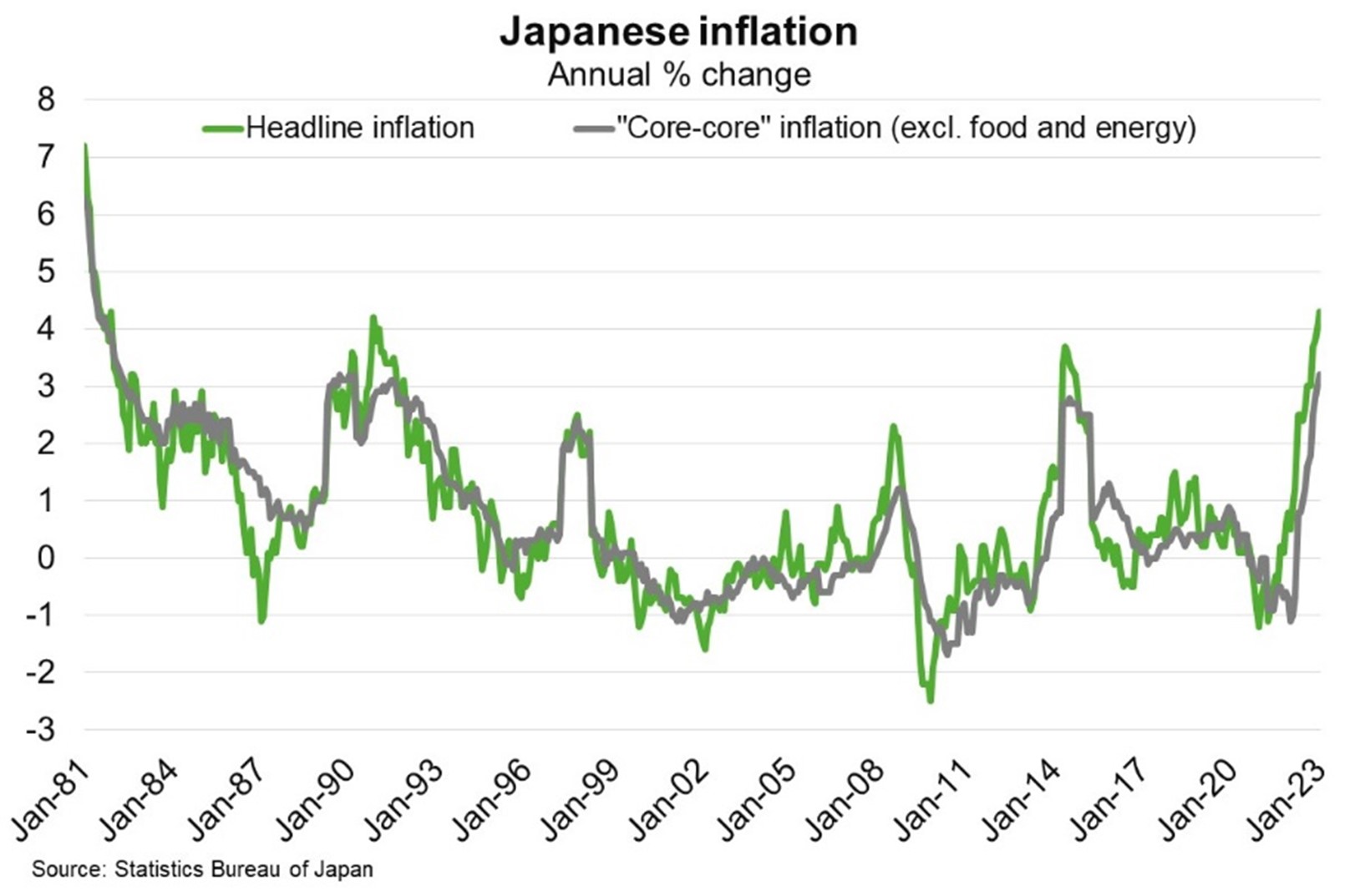

Large wage increases will support household spending in Australia’s second largest export market, helping to offset the squeeze on budgets from the highest Japanese inflation in four decades (Chart). Higher household spending that boosts services industries, and in turn, small business activity—which makes up 70% of Japan’s workforce—could help generate stronger wage increases across the wider economy. Given recent price growth has been driven predominantly by volatile external factors such as higher costs for food, energy and raw materials rather than stronger domestic demand, rising wages are needed to help authorities meet long-held goals of sustainable GDP growth and 2% inflation. Sustained growth in wages, inflation and the broader economy would further bolster Japan’s demand for Australian resources, energy and agriculture exports.