Australia—Clean energy investment boosts critical minerals exports

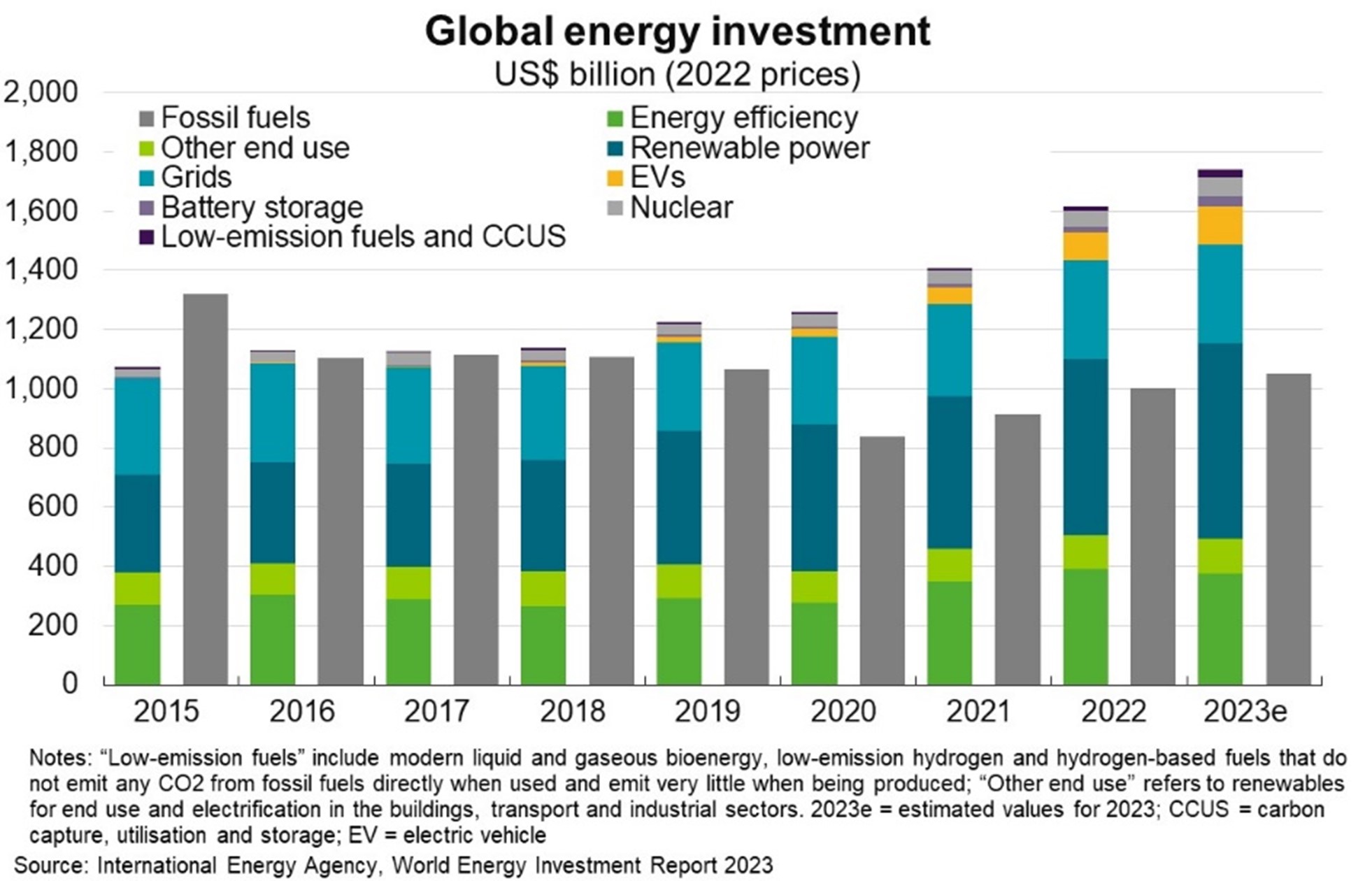

Global clean energy investment will hit a record US$1.7 trillion in 2023 (Chart), according to the International Energy Agency (IEA). A further US$1 trillion will be invested in unabated fossil fuels and power supply, down from $1.3 trillion in 2015. Renewable power, particularly solar, and electric vehicles (EVs) are leading clean energy investments. The IEA expects solar investments to reach US$380 billion in 2023, more than upstream oil for the first time. EVs investment is predicted to reach US$130 billion in 2023—more than double the level of 2021—with global EV car sales forecast to reach a record 14 million this year.

These trends are poised to continue. The IEA estimates that clean energy investment worldwide will need to jump to around US$4 trillion p.a. by 2030 to reach net zero emissions targets by 2050. In addition to climate goals, several factors are driving clean energy investments: a) recovering economies at a time of high and volatile fossil fuel prices; b) enhanced government policies to facilitate energy transition, including for example, the US Inflation Reduction Act; c) aligned climate and energy security goals, particularly in import-dependent economies; and d) strategic priorities as countries aim to develop clean energy industries.

Low-emission technologies require substantial metals and minerals, such as copper, nickel, lithium, aluminium and zinc. A typical EV requires six times the mineral inputs of a conventional car while an onshore wind plant requires nine times more mineral resources than a gas-fired plant. As a growing global supplier, Australian metals and minerals exporters stand to benefit. The Department of Industry, Sciences and Resources forecasts exports of lithium and base metals (and their raw material inputs) will rise to over $53 billion in 2027-28—almost as much export revenue as all coal types.