Emerging markets—Higher interest rates increase debt distress

Emerging market (EM) debt hit a record US$101 trillion (250% of GDP) in Q1 2023—up from US$75 trillion in 2019. High debt levels and rising interest rates have rapidly pushed up debt servicing costs. The Debt Justice organisation estimates that the external debt payments of 91 EMs will average 16% of government revenues in 2023, an increase of over 150% since 2011. Slowing economic growth adds to the challenges firms and governments face in generating sufficient revenue to counter debt distress. The World Bank forecasts growth in EMs (outside of China) to fall to 2.9% in 2023, from 4.1% in 2022, making these countries vulnerable to additional shocks.

Large EMs are proving resilient to these financial challenges and attracting stronger capital inflows. Indeed, the Institute of International Finance forecasts net capital inflows to EMs excluding China to reach US$80 billion this year, having recorded net outflows of US$221 billion last year. Many markets are benefitting from US dollar weakness and improved central bank credibility.

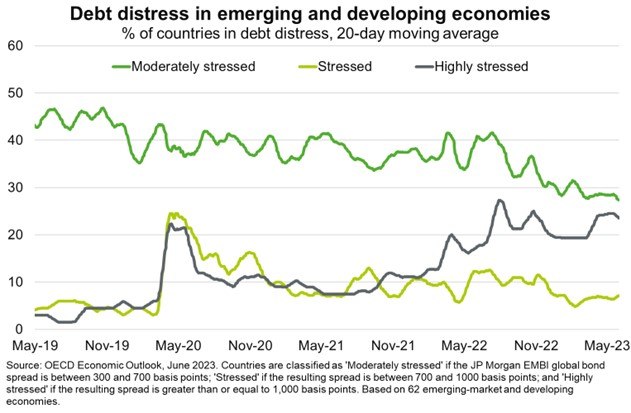

However, financial pressures are increasing in low-income countries. According to the IMF, 36 of 70 low-income countries are in or near debt distress. The OECD indicate that about one quarter of 62 EMs have a foreign-currency sovereign bond spread of over 10 percentage points compared to US equivalent bonds (Chart). Moreover, 40% of sovereign debt coming due within the next three years is in low-income EMs, raising financial stability risks. Tightening global financing conditions since US banking turmoil in March is also hampering access to external finance; the World Bank estimates that one out of every four EMs has effectively lost access to international bond markets. These financial challenges add downside risk to prospects for EMs (outside of China), which purchased 20% of Australian exports last financial year.