World—Savings stockpile may boost post-COVID export prospects

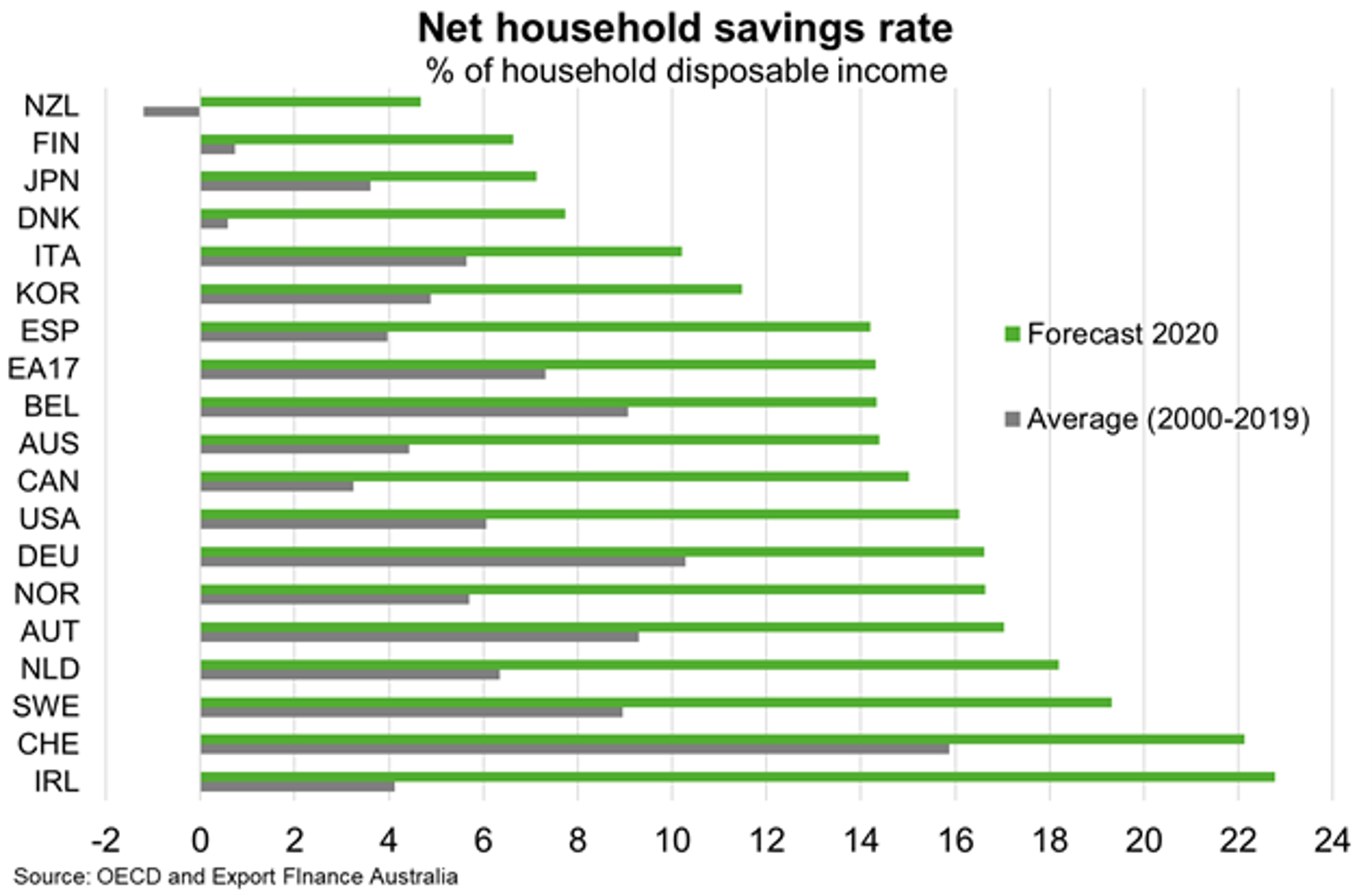

Household saving rates surged in many advanced economies last year despite global output contracting 3.3% (Chart). Household incomes were supported by unprecedented unemployment benefits, furlough schemes and stimulus cheques, while mobility restrictions lessened opportunities to spend. Indeed, Moody’s Analytics in an April 2021 report estimated that consumers have amassed excess savings of US$5.4 trillion (around 6.5% of global GDP) since the pandemic began. An extended consumption splurge could ensue once countries approach herd immunity and restrictions are eased. This is particularly the case given a surge in consumer confidence; the Conference Board global consumer confidence index reached a record high in Q1 2021. In particular, the US could see household spending accelerate rapidly this year given a swift vaccination rollout and recent new stimulus.

However, only a proportion of excess savings are likely to be spent in the forecast horizon. Savings have largely accumulated to high-income households, which have a lower propensity to spend. Oxford Economics estimate that excess savings in the US have accrued entirely to the top two income quintiles, while the bottom three quintiles have been squeezed. Any splurge will also be constrained to the extent that households perceive excess savings as wealth rather than income. This is more likely the case for households that have built up excess savings by spending less. Indeed, 70% of UK households that reported increased savings planned to continue to hold them in their bank accounts, according to the Bank of England. Others planned to use savings to pay off debts, invest or top up pensions. Last, foregone consumption in 2020 largely related to consumer services—such as haircuts and dining out—where there is less scope for demand to ‘catch-up’. Still, higher consumption as households dip into excess savings bodes well for the post-COVID recovery.