World—Bankruptcies to rise as policy support is removed

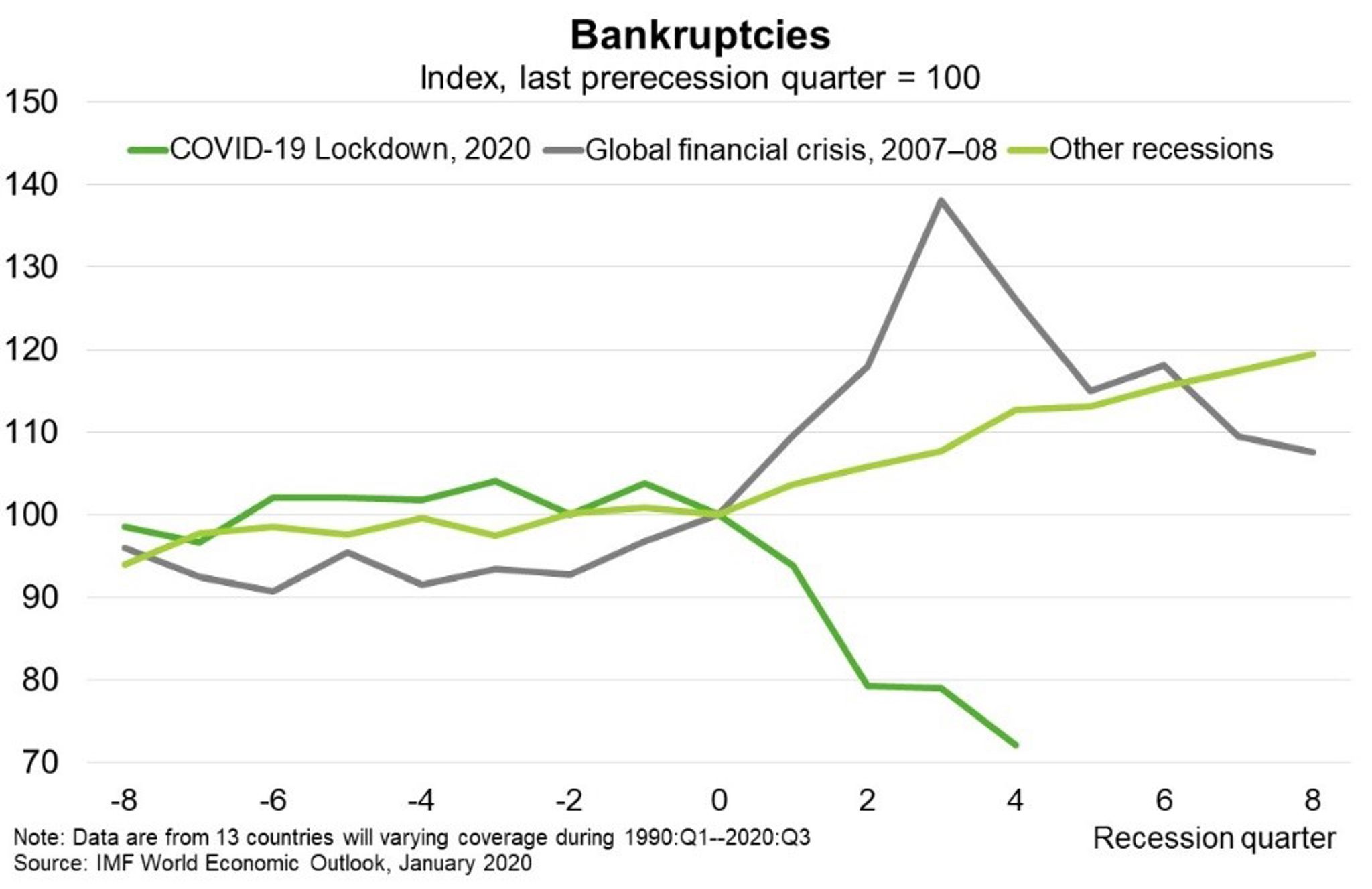

Amid the worst peacetime global contraction since the Great Depression, and as the pandemic drags on, one would expect bankruptcies to be surging. Yet, unlike during past downturns, bankruptcies have fallen during the COVID-induced recession (Chart). In Australia, bankruptcies were 40% lower in 2020 relative to 2019. Many major export markets have also seen significant declines.

Massive fiscal and monetary stimulus helped avoid bankruptcies that might otherwise have occurred. Governments supported businesses via loan guarantees and direct equity injections. Central banks have significantly expanded their balance sheets, including through purchases of private sector assets. This has supported financing conditions and allowed businesses to build cash buffers. In addition, wide-ranging furlough schemes have supported firms’ balance sheets, while temporary moratoriums on bankruptcy filings have been implemented in some countries.

Irrespective of policy support, bankruptcies have historically lagged GDP; they peak around one year after the initial GDP shock and remain elevated for at least another two. But particularly as authorities begin to taper support, bankruptcies are likely to spike. The Bank for International Settlements estimates that bankruptcies in advanced economies will be 20% higher in 2021 relative to 2019. Higher non-performing loans will result, risking harmful spillovers to the financial sector that amplify the strain on businesses. Pressure on banks to tighten funding conditions could impinge on the ability of firms to access bank credit. As such, higher bankruptcies could see both increased payment risks and higher borrowing costs for Australian exporters.